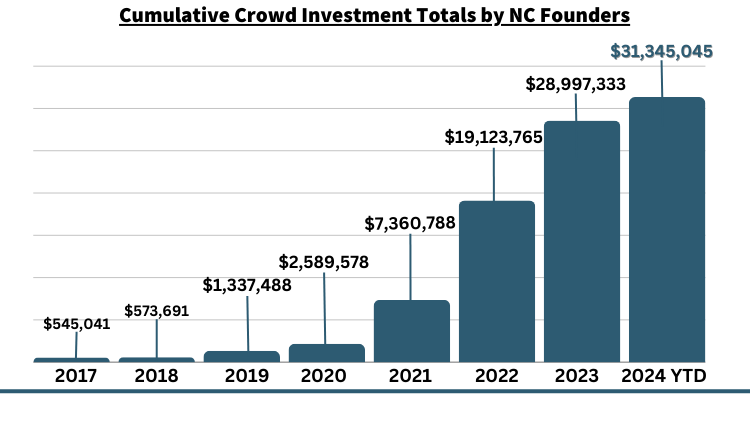

Your Opportunity

Everyone has an opportunity to build up their community by investing in small businesses they love and startups innovating new technology.

Live Crowd Investment Raises

Some Previous Successful Raises

180 Float Spa is locally owned and operated in Boone, NC. At 180 Float Spa you will experience zero gravity in a sensory controlled environment, encouraging the mind and body to connect, heal and find relief through float therapy.

180 Float Spa raised $21,000 in 8 months

Appalachian FC has brought NPSL Soccer to the High Country in a LEGENDARY way.

They raised $78,476 from 217 investors.

Aristotle Spirits is crafting beverages made with local NC ingredients and people are paying attention. They are the recent winner of 2 Gold Medals at San Francisco World Spirits Competition

Aristotle Spirits raised $74,200 from 39 investors.

BatteryXchange is a rental platform for portable batteries that supplies the power you need to live life charged. Pick one up at a mobile charging kiosk, and return to whichever kiosk is most convenient, even if you’re on the move.

BatteryXchange raised $111,975 from 90 investors in 10 months.

Big C Waffles’s goal is to create a franchise restaurant brand.

They raised $55,900.

Biotech Restorations is an environmental remediation company that utilizes an exclusively licensed biological bacterial formulary to naturally remediate soil contaminate materials known to be harmful to humans and the environment.

Biotech Restorations raised $28,650 from 53 investors in 4 months.

Converting to electric is less expensive than purchasing a new electric vehicle. Demand from fleets of school buses, last mile delivery vans and rideshare vehicles

BisonEV Retrofitting raised $35,810 from 27 investors.

Blanket Pancakes & Syrup is a Black-owned, all-natural pancake mix and syrup company with over $1M in sales in 2023 and products in 2,000+ stores across the U.S.

BisonEV Retrofitting raised $32,178.

BLAZnTECH introduced the world’s first and only Motorized Weapons Cleaning System, a pocket-sized power tool that manages to quickly and effectively (without any disassembly) clean the most commonly used rifles and handguns.

BLAZnTECH raised $68,706 from 153 investors in 12 months.

As of October 2021, BNNano is currently the only company in the world with a commercially viable manufacturing process for Boron Nitride Nanotubes, which they pioneered the patent pending NanoBarb™. It means aluminum can become as strong as steel or titanium. It means copper can provide advanced thermal management solutions. It means polyester can behave like Kevlar™. It means heat sinks can be made of plastic. In short, it means new capabilities in water purification, fire prevention and hypersonic travel.

BNNano was the 1st NC based ‘venture-grade’ company to raise $1M+ on Regulation Crowdfunding.

They raised $1,282,029 across 2 rounds

Boon leverages technology to match temporary staffing to an assignment that provides a better work relationship and in turn, higher quality care.

Boon raised $139,661 from 124 investors in 4 months.

Their BRÜES are loved by a diversity of patrons. Due to brand loyalty, Brueprint was able to strategically partner with Lonerider Brewing in 2022.

Brueprint raised $146,400 from 116 investors.

Chilling gives independent creators a platform to share content and compete against studios that create generic material just to hit metrics and sell tickets.

Chilling raised $291,850 from 519 investors.

The Cut Buddy’s mission is to make haircuts and grooming easier for everyone. The Cut Buddy makes personal grooming affordable with innovative products that give users the confidence and ability to do it themselves.

The Cut Buddy raised $156,050 from 149 investors.

CytexOrtho is a healthcare startup that is developing technology and solutions for younger patients with hip pain to address early joint degeneration..

They raised $496,296 in 3 months

Darklin Wars is breaking the pay-to-play model by creating a game that is familiar to experienced players in terms of basic mechanics, but is very rich and deep. Providing them with a player-centric experience that no other MMORTS current does.

Darklin Wars raised $24,102 from 36 investors in 6 months.

Devil’s Circle is a horror movie based on an East Coast legend.

Devil’s Circle raised $51,020

Women’s health market insights platform. The FemTech version of CB Insights.

FemHealth Insights raised $59,550 from 62 investors.

FG Communities is committed to improving manufactured housing communities, also known as mobile home parks. People living in our neighborhoods can have peace of mind that management cares about their quality of life, their homes and their communities.

FG Communities raised $3,930,000

Firehawk Brewpub is a Mount Holly, NC-based business offering high quality, well-crafted food and beverages that pay homage to the area’s history and heritage. A mix of bbq shack, fish camp and church potluck fare that evokes nostalgia while introducing modern techniques and fresh, seasonal ingredients not utilized by other area restaurants. A curated collection of small-batch creative beers, brewed in-house – Mount Holly’s first brewery! Creekside tables and water access will make this a truly unique experience.

Firehawk raised $80,200.

Flux Hybrids is retrofitting gas-powered fleet vehicles to turn them into plug-in hybrids

Flux Hybrids raised $199,112 from 180 investors.

Franny’s Farmacy is producing some of the best quality products in the industry. By controlling every step of the process from seed to shelf, Franny’s ensures that every customer enjoys a safe, natural, self-regulated CBD experience.

Franny’s Farmacy raised $272,174 from 544 investors in 15 months.

Located in Mooresville, NC, Ghostface Brewing recognizes that different beers are suited for different people.

Ghostface raised $150,000 with 13 days left in the round.

Based in Raleigh, NC, GoBe designed a snack spinner that empowers kids to pick their own snacks and manage their portions, and teaches them to listen to their body and self-regulate.

GoBe raised $359,634

Blockchain privacy from the software guy who built for restaurants and retailers. Indulj helps breweries manage mug clubs and memberships without sacrificing the personal touch.

GoBeep raised $554,383 from 116 investors.

Govinda’s Catering is making a Farmers’ Market Favorite into a full-service food truck!.

Govinda’s Catering raised $50,000 in one month.

Grain Dealers Brewery is on a mission to open the only brewery-restaurant within a 20-mile radius of Dunn, NC.

Grain Dealers raised $211,104

GreenLifeTech Corporation has intellectual property on technology which extends the life of produce by up to 5x and the freshness of other consumables, such as wine.

GreenLifeTech raised $292,870 from 112 investors.

HA! Snacks (formerly Macro Snacks) are macronutrient balanced, plant-based protein snacks designed to help you reach your health goals. They’ve created tasty snacks in the flavors you love, optimized with complex carbs and healthy fats. The gluten-free, NON-Gmo, vegan and kosher snacks contain essential macronutrients that allow you to indulge while getting the nutrition you need.

Macro Snacks closed 2 successful offerings:

In 2020, they raised $63,492 from 88 investors.

In 2021, they raised $85,834 from 190 investors.

Based in Hendersonville, NC, Hendersonville Toy Co. offers a variety of toys, adult & youth games, a wide selection of books and stationery items. The company is working to launch their online site.

Hendersonville Toy Company raised $26,700

HiveTracks uses bees as biosensors to track biodiversity.

Hivetracks raised $128,912 from 96 investors.

Homebody Yoga and Wellness is seeking investment to open a heated vinyasa studio in the heart of the historic Boylan Heights neighborhood in Raleigh, North Carolina.

Homebody Yoga and Wellness raised $53,000.

HUBB Kitchens (J. Johnson & Company L.L.C.) created ‘co-working’ for food & drink entrepreneurs and his startup landed a collaboration with the REEF & RDU to create the 1st multi-faceted ghost kitchen in an airport in the country.

In their second raise round, HUBB Kitchens raised $238,591 across 2 rounds.

Inbox Beverage is a leading innovator in the craft brewing and spirit industry. The company specializes in creating state-of-the-art microbreweries, distilleries, and other facilities using repurposed shipping containers.

Inbox Beverage raised $26,300 from 24 investors.

We are a community owned accelerator built by founders and run in collaboration with other founders. We help founders capitalize their startups and scale through crowd connections who propel their growth. Our goal is to help 1,000 founders by 2030.

We raised $131,975 from 29 investors.

Isosceles Phamaceuticals is helping to solve America’s opiod crisis. Their mission is to harness the power of the body’s endocannabinoid system to reduce pain and inflammation in an effort to reduce patients suffering.

Isosceles Phamaceuticals raised $5,060,000 .

Jenni Earle is a maker of talismans for courage and authenticity. They want each interaction with their brand to feel like a pep talk from your best friend.

Jenni Earle raised $11,207 in 3 months.

Josh Terry BitVault is a Bitcoin mining operation with an experienced team who has been operating Bitcoin mining operations since 2016.

They raised $671,549 from 1,221 investors.

“Kill Giggles” is a story, a screenplay, and soon to be a feature film like no other. Tommy dos Santos wasn’t born a psychopath, really, nor was he made into a sociopath, per se. He walked a path that will run red with the blood of the foulest most fiendishly frightening creatures ever conceived by man – CLOWNS.

Kill Giggles raised $21,338.55 from 56 investors in 5 months.

LiveWell Assisted Living & Home Care provides elder care through unique assisted living micro-communities and in-home senior care assistance. We have addressed the need and demand for residential care with new and more lucrative alternatives to the traditional nursing home business model.

LiveWell raised $162,464 from 54 investors.

Lonerider Spirits was born from Lonerider Brewing Company, one of the top 150 largest breweries in the U.S., and has the advantage of sharing that established branding.

Lonerider raised $129,239 from 113 investors.

Lonerider Spirits was born from Lonerider Brewing Company, one of the top 150 largest breweries in the U.S., and has the advantage of sharing that established branding.

Mike D’s BBQ raised $42,700 in under 2 months.

Mythic Massage provides creative ways for people to reduce pain without medications through the use of movement and advanced bodywork in a space that is aggressively affirming.

Mythic Massage raised $27,700 from 46 investors.

Neurish is creating a platform-based support system for people diagnosed with chronic conditions.

Neurish raised $54,300 from 6 investors.

The North Cove Leisure Club plans to be the ultimate outdoors lover’s playground. Boasting wide-open hiking and biking trails, elegant event spaces, and a state-of-the-art disc golf course, North Cove is a destination location for tourists and locals alike.

North Cove raised $385,800.

NpCloud Solutions EHR is enabling streamlined workflows and high-quality patient care experiences.

NpCloud Solutions raised $63,850 from 42 investors.

Founded in 2015 to craft a regionally inspired Single Malt, Oak and Grist offers a new generation of 100% from scratch spirits informed by the traditions of Scotland and inspired by those of Appalachia. The same passion and curiosity our mentor Edwin brought to his storied career in Scotland, is evident in every small batch of Oak and Grist’s spirits.

Oak & Grist raised $140,094 from 76 investors.

Based in Raleigh, NC, Offline is a subscription-based restaurant recommendation service that encourages people to disconnect from technology and try a new restaurant each month with family and friends.

Offline raised $2,000,000

OneFul Health is a pharmacy tech enterprise that has developed novel drug delivery products using patented automation and personalized medicine formulation software.

Incolo proudly serves as a paid business consultant and has an equity stake

.

Oneful Health raised $81,411

Ovanova is a free service that organizations and causes use to raise funds by raising solar awareness within their community of supporters.

Ovanova raised $23,850 from 67 investors in 3 months.

Plat Capital focuses on making it easier for anyone to invest in real estate. They acquire, manage, and dispose of properties through location focused real estate funds.

Plat Capital raised $658,533 from 892 investors.

Project Transcend is social media for capturing one’s life story, and ultimately their legacy. Rather than manufacture content for clicks, likes, and mass engagement, the Transcend platform encourages users to capture authentic moments, and share meaningful memories that are accessible for generations to come.

Project Transcend raised $55,248 in 2 months.

QuirkChat is a social video and collaboration platform for geeks and hobbyists that emphasizes community moderation and community building.

Quirktastic raised $82,962 from 219 investors in 3 months.

The Residences at the Albemarle Hotel is a real estate redevelopment project in the heart of Stanly county. We’re pursuing a local market opportunity while reclaiming and protecting the history of Albemarle for future generations to enjoy.

The Residences at the Albemarle Hotel raised $1,800,000 in 1 month.

The Residences at Diamond Ridge is an apartment complex located just 1.25 miles from downtown Winston-Salem, North Carolina. Although the complex is fully leased, there is an opportunity to renovate and add long-term value to the property by doing significant interior and exterior renovations and increasing rents to market levels.

The Residences at Diamond Ridge raised $290,000 from 79 investors in 4 months.

Retro Meadery makes meads with high-quality honey right in Burgaw North Carolina. They also leverage fresh produce from our awesome state.

Retro Meadery raised $45,300.

- 17 patents awarded

- $44M in Net Revenue

- Network spanning 6 continents and 40 countries

Saebo raised $599,874 from 841 investors.

Scinovia is based our of Raleigh and produces state-of-the-art diagnostics to help doctors make more data-driven decisions during procedures to save more lives. Scinovia developed VUFLOW, the future of non-contact imaging diagnostics for blood flow during surgery.

Scinovia successfully raised $115,904 from 82 investors.

Simple Kneads is a bakery providing artisanal gluten-free bread with whole ingredients, clean label, no GMOs, no eggs, and no dairy.

SimpleKneads successfully raised $ 173,256 from 249 investors

Sol’s Arcade + Taproom is seeking investment to cover our startup costs and initial operating expenses of a new arcade + taproom coming to Downtown Fayetteville.

Sol’s Arcade + Taproom successfully raised $ 23,800 .

Solib Solutions is driven by research and innovation. They’re solid-state, low-cost, hybrid batteries aim to revolutionize the battery industry.

Solib Solutions successfully raised $ 53,669 .

Soteria’s mission is simple: prevent car accidents; save lives. The purpose of creating the Safe Driving System is to offer parents and other users technology that can eliminate up to 86% of car accidents from ever happening.

Soteria raised $170,010.00 from 91 investors in 5 months.

Sully’s Golf & Gather will be the perfect place to work on your game! We’ll have a premier indoor driving range with launch monitors to see your ball flight, state-of-the-art simulators, an indoor putting green, private teaching suite, private event space, bar, and more.

Sully’s Golf & Gather raised $596,200 in a parallel crowd investment + traditional raise.

SWIPEBY is a technology platform that empowers businesses to drive off-premise sales and connect with customers. SWIPEBY gives customers direct access to their favorite local restaurants through easy mobile ordering and convenient curbside pickup.

SWIPEBY raised $324,629 from 1,125 investors in 3 months.

The 2.0 Collective is a career strategy + support collective focused on minimizing career friction for you – the ambitious, everyday human.

The 2.0 Collective raised $64,400 from 21 investors.

The Good Kitchen makes eating well easy. When Amber first started The Good Kitchen, she had a simple concept in mind: to make nutritious, healthy and great tasting meals easily accessible to everyone. It’s a rather simple concept, borne out of her own life experiences, having seen firsthand the importance of eating well in order to live better. For herself and her family.

The Good Kitchen raised $290,781 from 540 investors.

Village Juice exist to make eating healthy taste as amazing as it is for your body.

Village Juice Co raised $224,990 from 317 investors in 2021.

2 Out Of 3 Main Street shops have no Web solution, Virtual Storefronts is aiming to end that for good.

Virtual Storefronts raised $76,294 from 38 investors.

VitalFlo helps doctors measure, monitor, and predict their patients’ lung health.

VitalFlo raised $876,828 from 127 investors.

Over the past nine years, Wehrloom has grown from a walkout basement into a manufacturing facility and retail store that harvests and package honey, produces a full line of skincare products, beeswax candles, and is a “winery” focusing on mead.

Wehrloom raised $107,000 from 119 investors in 7 months.

When a little girl is found after going missing, only her older brother recognizes the evil force that has returned in her place.

Where’s Rose raised $103,657 from 182 investors in 6 months.

Y’all is a celebration of culture and heritage, the best of every southern state, a recipe for togetherness and we fill our bottles with it. We believe great food has the power to bring people together. To unite us. We believe the South is meant to be shared. It is rich in history and flavor. And so are our sauces.

Where’s Rose raised $90,000 from 58 investors.